This is a topic that is a bit close to me. Not sure why, but I have always been very interested in commerce, business and personal finance. Money or capital for that matter is key in terms of optionality in life. As far as personal finance is concerned, the entire point of view is to bet on growth/stability within respective risk boundaries. Understand that there is no free lunch and thereby accordingly make the prudent investments.

Getting personal finance in India correct is important to help you remove finance or money as a variable from this optimisation equation called life. By getting it right, one will be able to work for the more important things in life.

Return vs Risk

Risk and Return are the two components of an investment or bet. With every bet or investment, we are trying to maximise our returns as per the proportional risk. But at the same time, not all risk is the same and there are different ways to calculate and account for them. An understanding of the kind of risk being taken with every investment or bet is needed.

With time and scenario, this relationship between return vs risk changes for the specific asset, bet etc. This is what someone is trying to optimise for when they trade. If you can consistently make optimal bets or investments where the return/risk favours beat the market standards, you over the long run, will better the market index returns.

Types of Risk

When investing, it’s important to take into account the following risks

- Counter Party Risk: Is the entity or the person, you are dealing with reliable. Can they hold their end of their bargain. When you buy from a centralised exchange like NSE, you are offloading this risk to NSE. They take care of it.

- Liquidity Risk: Not all assets are liquid. You cannot convert them to money as quickly as possible. One of the prominent ones being real estate and shares in private companies. Since, these are dark markets, there is no price discovery as well. One needs to do their own due diligience. It’s not easy to get out of such investments fast due to illiquid markets.

- Concetration Risk: Having majority of your savings/networth in a single asset exposes you to concentration risk, as most of your portfolio’s return is dependent on a single asset. This is only good when you are running your own business because you are controlling more variables in that situation.

- Inflation Risk: The basic intent behind investing to preserve the capital’s purchasing power. In growing economies, inflation is a constant threat and the investment vehicle chosen needs to beat inflation at the minimum. Equity investments in the long run have beaten inflation growth in majority of development countries.

There are more nuanced forms of risks associated with investing, which can be explored here. But one can broadly evaluate any kind of investment based on the above.

Portfolio Allocation

Instead of considering investments as a single asset class thing such as putting all your money in real estate or everything into gold etc, the right investment strategy involves capital deployment in form of a portfolio allocation done keeping short and long term goals.

For short term allocations aka 2-3 years period the approach could be using safe and consistent assets such as debt, fixed deposits etc as preferred modes.

While for long term investments (5-10 years and beyond) one can consider equity or even real estate development projects. Having said that, real estate is more speculative in nature and often suffer from concentration risk.

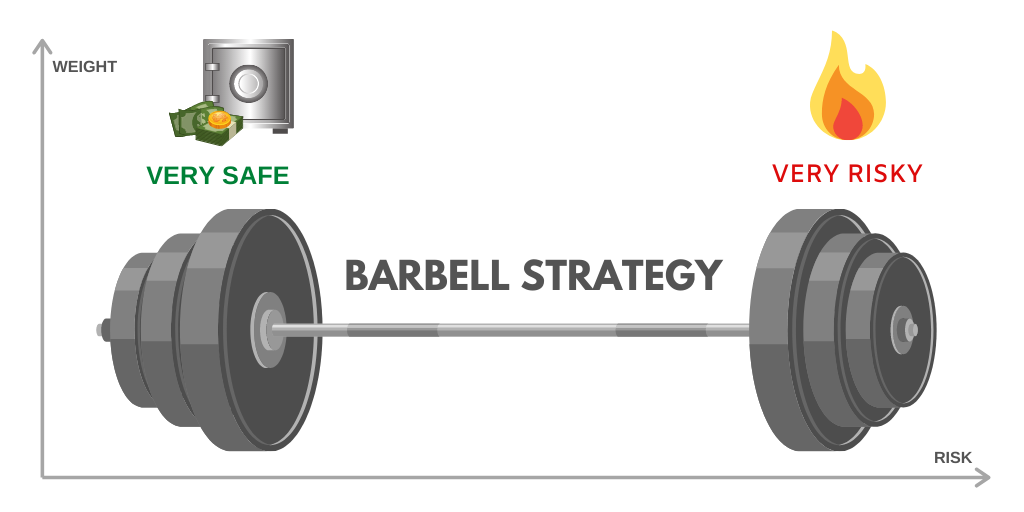

Portfolio allocation has multiple strategies and is covered here. Personally, for young folks, I will recommend the barbell method of portfolio risk allocation

- 80-90 % Portfolio: Long term safe and aggresive assets (aka equity/MFs) plus liquid investments to cover emergency requirements.

- This Mutual Fund portfolio would also include international equity funds to hedge currency and country risk.

- I would use gold mutual funds (<10% of overall MFs) as a part of hedge portfolio. Any further allocation, should be coming from the 10-20% risky bet.

- In the long run, the India’s index funds should do very well.

- 10-20% Portfolio: This includes all risk and 1-0 bets such as crypto investments, own side hustles, lease financing, angel investing etc.

- The whole idea being to take these random but high personal conviction (low market beta) shots. Bets, where you strongly feel right but the general market sentiment is not so warm. If they work, they would single handedly mutiply the whole portfolio returns.

- Should they not work, we still build a base line portfolio returns through the safe part of the barbell.

- I would put own stock portfolio as a part of this 10-20 % risk bets.

Resources

Given the broader understanding of the equilibrium, return vs risk. These are some of the popular sources of content around personal finance

- IndiaNivesh : A personal finance, has some interesting insights, thought take everything with a pinch of salt as you should within the finance space.

- IndiaInvestments: A popular finance sub reddit for Indians. Has grown quite a lot and has plenty of interesting points on take on personal finance dos and don’ts.

- Let’s talk money: A personal finance in India 101 book recommended even on the sub reddit. Any one looking to start thinking of personal finance from scratch, should give this a read.

- Optimising MF Portfolio: This blog talks about different types of MFs to consider and how to split allocation between the same.

If you want me to take a look at your current strategy and need a soundboard for your investing thesis. Feel free to drop a note. Been helping quite a lot of tech friends across the board. This blog has been a way to productise going beyond the basics.

To Join the closed community that discuss financials from a mature and risk perspective. Reach out through the form below.