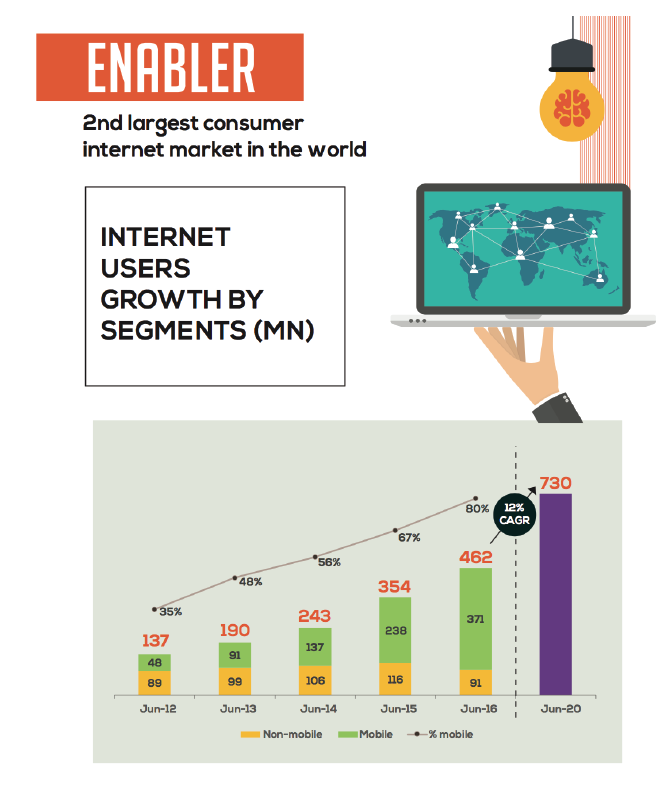

Over time, the number of startups in all fields whether it be technology, health, education, any other field, has increased. Though, all startups face lots of challenges. From hiring the right number of people at the start, where and when to allocate capital and so on. All of this has been accompanied by this tremendous growth in the internet consumer base across the country.

These high risk, high return startups have attracted a lot of monetary interest. The amount of money invested in startups has increased exponentially in the past few years. Despite being an event with a low success rate of less than 10%. VC’s have invested an unprecedented 26.5 billion USD in 2021. A lot of this money should come back with increased angel investing activity in India.

Investors have different incentives to invest in these startups ranging from diversification of portfolio, understanding a new sector to family offices looking to enter new market segments.

Who is an Angel Investor?

An angel investor (aka private investor, seed investor or angel funder) is a high-net-worth individual who provides financial backing for small startups or entrepreneurs. Typically in exchange for ownership equity in the company. This is a stage when a business has many unknown unknowns.

- An angel investor is usually a high-net-worth individual who funds startups at the early stages, often with their own money.

- Angel investing is often the primary source of funding for many startups. In most cases comes from friends and family.

- These types of investments are high-risk investments and ideally should not be more than 5-10% of a prudent investor. They form part of high risk-high return part of the portfolio.

Angel investors have excess funds available and are usually looking for exponential returns. They usually look for at least a return of 25% on their overall investment portfolio. Most of these investments are highly illiquid and can take more than 5 years to return anything if at all.

Who can be an Angel Investor?

Anyone can be an angel investor in India. Unlike AIFs and other complex financial vehicles, one does not need to be an accredited investor to be an angel investor in India. This should make angel investing in India easier. Individuals, HUFs, Family Trusts and sole proprietorships, which meet the criteria of accredited investors is as follows:

- Annual Income >= INR 2 Crore OR

- Net Worth >= INR 7.5 Crore, out of which at least INR 3.75 Crore is in the form of financial assets; OR

- Annual Income >= INR 1 Crore + Net Worth >= INR 5 Crore out of which at least INR 2.5 Crore is in the form of financial assets.

What are Angel Groups?

“Angel groups” are groups of angel investors who regularly convene as a group, usually in-person, to evaluate and invest in startups. The practices of specific angel groups often range widely. Angel groups typically focus on a concentrated geographic region, typically a single state or region of a state, in some cases a particular city or metropolitan area. Occasionally angel groups will focus on an industry sector in addition to or rather than geography.

Some prominent ones are Mumbai Angels. They are one of the first angel investing groups in India.

Angel Investing from Startup POV

Why should a business or a startup seek angel investing when it should be able to take either a bank loan or use bootstrapped funds. Raising money through this route could be useful in ways other than the money:

- Angel investors usually invest in industries they know well and have some expertise in. So, one can seek expertise and experience.

- Banks don’t lend money without collateral or track record.

- The whole process can take anywhere between 4-6 months.

But like any decision, this comes with its own set of challenges:

- The primary disadvantage of angel investors is the loss of control as they raise capital.

- Without majority stake, once can lose control and direction.

- Some entrepreneurs have had adverse experiences with some angel groups. Complaints range from prolonged investing periods to long due diligence etc.

- Sometimes, the investments may not be market linked.

What is Tyke

Tyke is a platform that makes angel investing simple and accessible. One can own a portion of the next upcoming startups and help the entrepreneurs in the way. Founders and investors can partner with Tyke and raise and invest money respectively.

The minimum size of the investment can be as small as Rs 5000. Some of the platform features are:

- A good catalog of ongoing investments.

- Simple reporting and MIS to track investments.

- Basic financials along with founder presentations.

- Easy and almost frictionless execution of work.

Logistics of Investing?

There are 6 simple steps to start investing:

- Signup and create a profile.

- Complete quiz to evaluate investing knowledge.

- Understand the specific investment deal in terms of risk, interpretation and due diligence.

- Assign an investment amount, and complete the process of investment by agreeing to T&C, consent agreement and so on.

- Finally, the startup will sign a T-SAFE within 48 hours, followed by the investor. This typically gets wrapped up in a week.

- The angel investment is returned back to the investors in case, the campaign is unsuccessful.

There are live deals and private deals on the website. One can easily evaluate all the deals and invest accordingly.

Investment Process

- Startups can easily invite investors and fundraise so that they can easily focus on the startup. Startups can invite anyone with just one click and further accelerate the fundraising process through this technology

- The banking partner holds the investments in an escrow during the campaign process.

- The investment can be cancelled within 48 hrs of investing by writing to Tyke (support@tykeinvest.com)

- Every campaign once it reaches the minimal funding stage. The funding process is either closed or continued beyond the deadline.

- The company reserves the right to reject any investment in whole or part.

Angel Investing Risks?

Angel investing has multiple risks fraught with it, especially in an immature market like India.

- Loss of Capital: Investments in startups/early-stage ventures bear an inherent risk of not ensuring full-fledged profits or returns from the investments. It is for this reason that it is generally recommended to create a diversified portfolio of investments. All angle investing deals should be treated as 0-1 bets.

- Lack of Liquidity: Liquidity refers to equity shares that can be sold with ease. However, equity investments in the companies are highly illiquid as such companies are either unlisted or private.

- Rarity of Dividends: The Companies may most likely be unable to pay any dividend throughout the life cycle of an investment. Therefore, in order for you to earn a return out of any of your investments, a sale or IPO is necessary.

- Diluation: The companies will typically raise additional capital in the future. Therefore, the investor shareholding will be diluted.

- Performance: The Company’s forward-looking statements, containing opinions and beliefs, are based on a number of estimates and assumptions that are subject to significant business, economic, regulatory, and competitive uncertainties.

- Tax: One is liable to pay taxes on any dividends or gains you receive from your investments in the company and payment of such taxes is entirely your responsibility. Therefore, you should consult your tax advisor for more information on these matters.

What is T-SAFE

T-SAFE is Tyke’s simple agreement for future equity. A T-SAFE is an investment contract between investors and startups looking to raise capital. Individuals make investments for the chance to earn a return—in the form of equity in the company or a cash payout.

The T-SAFE, created by Tyke, is an adapted version of the SAFE, a financial instrument created by Y Combinator. It is widely used by angels & VCs investing in startups across the globe. It has been designed specifically to work for investment campaigns accepting hundreds or even thousands of investors, and it’s used by several industry stalwarts in various forms.

How does it work ?

Investors using the T-SAFE get a financial stake in the company but are not immediately holders of equity. It takes the legal form of Compulsorily Convertible Debentures (‘CCDs’) at the time of issue. The CCDs are then converted into equity during ‘activation events’ like acquisition or IPO.

Why T-SAFE?

- Efficient: T-SAFE is a one-document security without numerous terms to negotiate, saving money in legal fees and reducing the time spent negotiating the terms of the investment. Startups usually only have to negotiate one item: the valuation cap or the discount cap.

- Benefits of Equity without hassles: T-SAFE is designed specifically as a financial instrument without the hassles of attending general meetings or signing unnecessary documents. It comes with detailed information rights and easier exits while increasing in value just like equity shares.

- Safety First: A T-SAFE holder gets preferential rights over traditional shareholders in terms of repayment. If the startup gets liquidated, a T-SAFE holder is paid before any shareholder.

- Cheaper: The legal costs are bare minimum.

Tyke’s Pricing

The only charges are the convenience fee by Tyke when the investor is making the investment. There are no other charges besides this such as maintenance, tracking etc.

For a startup, there are no such costs associated. Processing, campaign management, everything is free.

I think it’s an interesting investing vehicle and should be part of one’s high-risk high return portfolio. Happy to discuss the investing experience.